Nowadays, we cannot imagine the life in the place of different varieties of loans. According to Experian http://availableloan.net/personal-loans-nm/kingston/, over forty two% percent from Western people have some style of home loan becoming home buyers. Exactly what is home financing in general? Having an answer arrives Investopedia, detailing the niche in more detail.

The expression home loan refers to a loan accustomed get otherwise care for a home, house, or any other sorts of a residential property. This new borrower agrees to blow the lending company throughout the years, usually from inside the several typical payments that will be divided into principal and you will attention. The house serves as guarantee so you’re able to hold the loan. A borrower must get a mortgage due to its prominent lender and ensure they see multiple requirements, and minimal fico scores and off repayments. Mortgage software undergo a tight underwriting techniques just before they arrive at the fresh new closing phase. Financial systems differ in line with the demands of debtor, including conventional and you can fixed-price funds.’ (Source)

Ok, so you got always the term financial, exactly what today? There are multiple version of mortgages available. Continue reading and get acquainted with those hateful pounds.

Mortgage loans have different shapes and sizes. Our very own experienced Repaired-speed and you may changeable-speed mortgages are a couple of of the most extremely regular sort of mortgage loans available today.

Financing that have a fixed-rates

A fixed-price mortgage has an interest price you to stays constant during the loan’s period. This indicates that the mortgage money will continue to be a comparable – that is, they are repaired – throughout the loan’s label. Fixed-rates fund render stability facing altering industry conditions, additionally the cover off understanding how much their monthly homeloan payment will be.

Finance that have adjustable rates

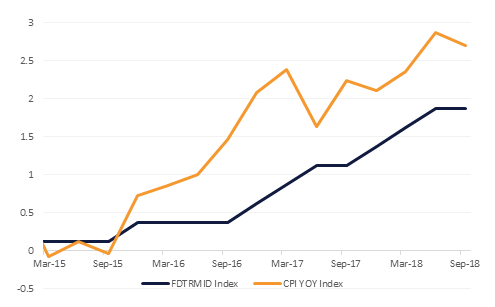

Possession (adjustable-rate mortgage loans) is actually mortgage brokers having changeable interest rates that will will vary within any time. They will have less beginning rate of interest than just a fixed-price loan. After that very first identity, the rate are changed several times a day oriented on a market rate of interest index. Your upcoming monthly installments is generally undecided due to rate of interest transform that will improve otherwise decrease your percentage. This means that, Fingers is actually risky throughout symptoms out-of ascending interest levels, even so they would be cheaper in the end if interest levels slip.

Financing with only desire

A certain kind of financial where their monthly premiums merely coverage the interest to your loan equilibrium the bill is not-being secure. Interest-merely payments usually are valid for a certain big date, and the newest payments go back plus the debtor needs to spend principal and additionally desire.

Now, let us move on to the main area of one’s post. We need to help you get regularly home loan companies. This is why we need to expose you to Very first Republic Bank. We are going to enter into outline and try to submit an out in-breadth feedback, and that means you understand what to expect out of this company.

However, very first, possibly a few words in the Very first Republic Bank in itself.

Basic Republic Bank’s financial and re-finance department focuses primarily on domestic mortgages, in addition to really approved domestic home loan-backed ties, mortgage refinancing, student education loans, student loan refinancing and personal loans. Us government department and you can organization issued loans and you can home loan-recognized citation-because of tool. The complete the residential financial equilibrium was $9,793,000, as the complete a good industrial home loan balance try $2,802,999,000.

San francisco bay area-established Earliest Republic Bank was a publicly-replaced firm. Federal Set-aside provides analytics away from you to states that corporation have $67.nine billion from inside the residential property. Basic Republic Bank had a total mortgage level of $8.8 mil in 2015, predicated on study on the User Financial Security Agency (CFPB). When it comes to loan volume, the business ranking 27th in the us. The organization are a person in FDIC and Equal Construction Financial Financial support.