Our very own Loan calculator tool helps you see just what your monthly repayments and total costs can look including along the life of the loan. We determine this new payment, taking into account the mortgage count, interest and you may loan term. New shell out-off otherwise amortization of your money over time are determined because of the subtracting the amount of principal from each of your monthly obligations from your own mortgage balance. Throughout the years the main portion of the monthly payment reduces the mortgage equilibrium, causing an effective $0 harmony after the mortgage label.

A great deal more out-of SmartAsset

- Evaluate unsecured loan cost

- Should you refinance?

- Assess the expense of student education loans

- Simply how much in the event that you cut for advancing years?

- About this answer

- Find out about unsecured loans

- Infographic: Urban centers with Financial obligation Smart People

Consumer loan Calculator

However, like all loans, personal loans commonly you need to take gently. Once you’ve determined how much you really need to obtain and you can how much cash you really can afford to blow back per month, you could begin wanting personal loans. Consumer loan calculators help you know very well what you may anticipate.

Thinking if the a consumer loan suits you? It is important to wonder precisely why you have to borrow money. Is-it to settle costs otherwise relocate to a local with increased job opportunities? Can it be to eliminate large-attract personal credit card debt? A few of these try problems where this may seem sensible so you can envision an affordable personal loan.

Exactly what do i mean by the sensible? Genuine value was the one thing out-of both the personal bank loan interest rates as well as the personal loan repayments over the years. Also a loan having a low-value interest you will definitely give you that have monthly premiums which might be higher than you can afford. Certain personal loans incorporate adjustable rates that can improve over time of time. This type of loans is actually riskier as opposed to those with fixed rates of interest. If you are looking during the changeable rate of interest funds its a great good clear idea to ensure that you will be able to afford it even when your interest has reached the greatest section you can easily when it comes.

Start with the speed

The higher your credit score, the lower the pace you will probably qualify for for the a personal loan. If you were to think you are searching for a good consumer loan later on, it’s best to reach performs increase their credit score. Tournament people problems on your credit history, pay your own bills promptly and continue maintaining your borrowing from the bank utilization proportion less than 30%.

Immediately after you happen to be willing to search for a personal loan, don’t just look at you to sourcepare the fresh new prices you can buy regarding credit unions, conventional banking companies, online-merely loan providers and peer-to-peer financing sites.

When you’ve receive a knowledgeable interest rates, take a look at almost every other regards to the finance into the provide. Such as, its basically a good idea to keep away from repayment financing that are included with pricey credit lifetime and you can borrowing from payday loan Jackson Lake the bank impairment insurance coverage. These guidelines will be voluntary but staff off lending organizations commonly slope all of them as the mandatory for anyone who desires a loan. Specific applicants is informed they are able to merely move the purchase price of insurance coverage in their personal bank loan, capital the fresh new add-ons which have borrowed currency.

This makes these types of currently large-attention financing more pricey since it enhances the effective desire price of the financing. A tiny brief-label loan is not worth entering enough time-label loans that you are unable to pay back.

Be cautious about fees and penalties that make it more difficult getting consumers to settle the personal loans. An illustration: Prepayment charges you to ask you for in making even more costs on the mortgage. Comprehend mortgage conditions carefully and check to own vocabulary one to explicitly claims the borrowed funds doesn’t carry prepayment penalties.

Abstain from funds that are included with get off charge, a charge particular loan providers cost you after you pay off your own mortgage. You shouldn’t have to pay an exit percentage, otherwise work with a lender who wants to punish your to possess personal loan installment.

Think Possibilities Before you sign The Label

Discover selection so you’re able to commercial signature loans that will be worthwhile considering prior to taking with this kind of loans. When possible, borrow money from anybody you like that is ready to matter an initial-label financing within zero otherwise low interest. Rather, for those who have highest-desire credit card debt that you like to eliminate you may also have the ability to do credit cards balance transfer.

What exactly is a balance transfer, you may well ask? Certain credit cards bring an effective 0% Apr on the the fresh new requests as well as on your own old, moved equilibrium to have a-year. If you’re able to here is another sales and you will manage to repay what you owe while you have the introductory interest you are better off going for an equilibrium import than to own a consumer loan. It’s important to pay off your balance ahead of your Annual percentage rate leaps on introductory price to some other, higher level.

Financing calculators can help you find out whether or not a personal bank loan is best fit for your position. Eg, an effective calculator makes it possible to find out regardless if you are better off that have a diminished-rate of interest over a long identity or a higher interest more than a smaller identity. Just be able to see your monthly premiums with assorted loan rates of interest, wide variety and you can terms and conditions. Then, you could potentially aim for a payment per month dimensions that fits toward your financial allowance.

Summation

The financial obligation sells particular risk. If you opt to look for a personal bank loan, wait around to discover the best price you can get. Yes, payday loan and fees funds promote brief fixes, nevertheless these loans can quickly spiral out of hand. Even individuals with poor credit could get a good deal by interested in financing off an equal-to-peer site than they may be able away from a beneficial predatory lender. Come across for yourself because of the comparing the choices which have an unsecured loan calculator.

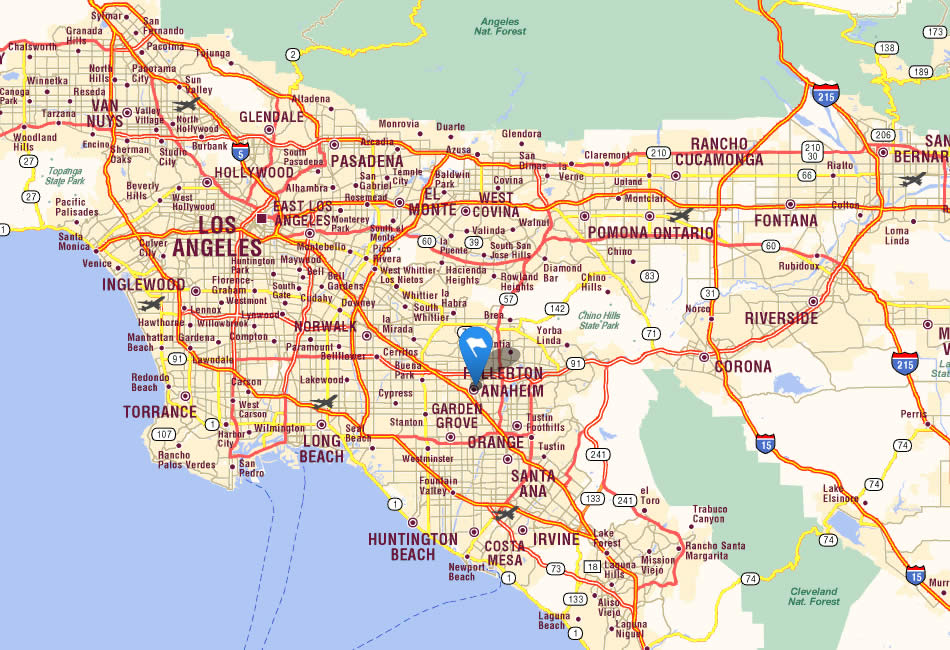

SmartAsset’s interactive chart shows the fresh new cities in the country where some one is the very obligations smart. Zoom anywhere between says together with national map to see in which anybody are best with respect to obligations.