Edited By

Home financing, or home loan because the they’re known as, lets buyers to cover a property throughout the years. Immediately following several years, mortgage owners pay off the money it use that have notice and you can very own the house or property outright while the loan is repaid. To invest in a house may be the greatest single purchase or resource you create inside your life. Very, before you sign on the dotted range, its smart understand the basic principles.

What’s a home loan?

Home financing is actually a loan contract between a loan provider and you may an effective customer always pick a residential property. You (the buyer) repay the mortgage inside instalments more than a set time, constantly 20 to help you three decades. The duration of the borrowed funds is shorter otherwise lengthened, according to the count you borrow, among additional factors.

Financial vs. home loan

The brand new terminology home loan and you may mortgage basically imply a similar thing: Both of them determine the borrowed funds buyers remove to find a property. However, there’s in fact a small difference in the 2 terminology.

- A mortgage ‘s the currency lent to acquire a property otherwise property.

- Home financing refers to the legal loan arrangement between the borrower and also the bank.

Regardless of this semantic variation, you can constantly use the conditions interchangeably. On this page, we dump one another terms and conditions while the exact same.

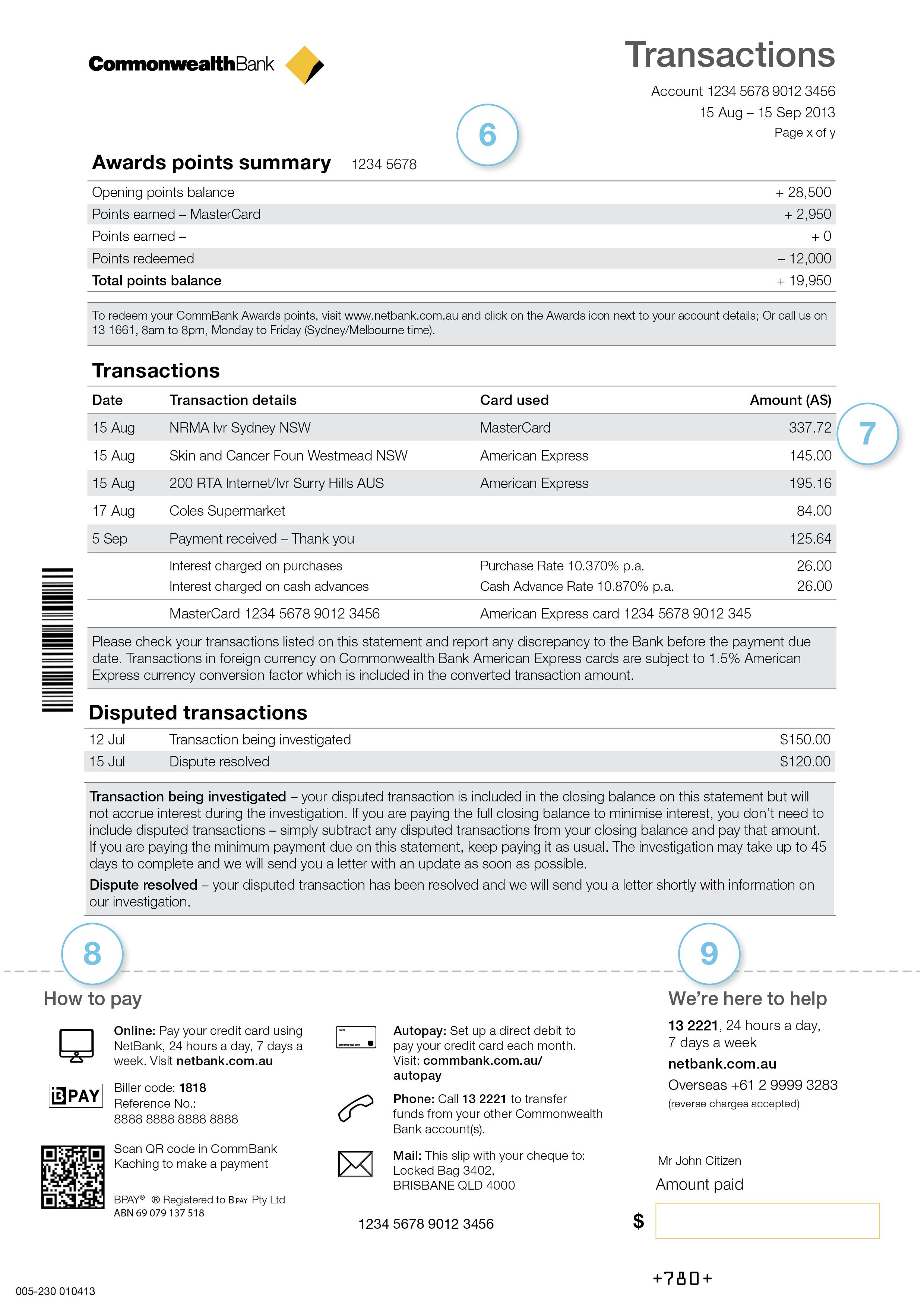

How do mortgages are employed in Australian continent?

Mortgages are similar to other sorts of financing, such as an auto loan: Your borrow cash to fund the thing and you will pay they right back through the years. But not, discover unique points to help you home financing which might be worth facts.

House put

If you use home financing to buy property, the financial institution (a financial otherwise lender) normally requires a great 20% put into the mortgage – called the household deposit. Which deposit pays a number of the loan upfront and you can reduces the risk into the financial. It also permits you, the consumer, to stop using LMI (Lenders Mortgage Insurance). LMI is a kind of insurance rates that loan providers want should your put try significantly less than 20%. Deposits more than 20% are typically maybe not at the mercy of LMI.

Prominent and you will attract

The primary is the legs level of the loan. Eg, if you buy a house having $500,000 and you will shell out a good 20% deposit ($100,000), $eight hundred,000 off dominating is actually owed on mortgage.

Desire, yet not, ‘s the price of borrowing currency. The financial institution costs interest for the matter your use more than an excellent lay time frame, looking at the mortgage count as well as your credit rating, among additional factors. For the , an average interest to your proprietor-occupier lenders try 5.89% (repaired and you will changeable combined), with respect to the Put aside Lender regarding Australian continent studies.

Financial identity duration

Lenders can vary in total https://paydayloancolorado.net/blanca/, but the majority may include 20 to help you thirty years, with reaching forty years.

The new stretched our home financing, the greater amount of focus you are able to spend. Ergo, make an effort to secure a home loan into the shortest name size your are able to afford.

Domestic collateral

As you pay back their mortgage, possible start earning collateral regarding possessions. This is your residence’s newest well worth without any kept mortgage equilibrium. Eg, if the house is valued on $five hundred,000, along with $two hundred,000 remaining on your own home loan, you should have roughly $three hundred,000 into the security. Think about, guarantee cannot imply control – it refers to the value of the house that you are entitled to.

Possessions control

When you have home financing, you do not own the property if you don’t repay the borrowed funds during the complete. On simplest means, the financial institution pays the seller into household, and then you pay off the lender.