Threat insurance policy is an expert particular insurance policies that provides visibility against possessions ruin due to certain natural situations and you will specific threats. It’s built to cover people throughout the monetary fall-out of those unforeseen disasters. Fundamentally, it will not were ton publicity, and that should be bought independently, possibly from the national otherwise individual flood insurance policies carriers.

Navigating the fresh new state-of-the-art realm of real estate concerns more than just complimentary people through its fantasy homes otherwise helping vendors when you look at the sale the characteristics. It border a thorough comprehension of the latest range aspects of homeownership, such as the important character out of insurance rates.

Keep reading to learn what chances insurance policy is, how it compares to home insurance, the relevance to own homebuyers, and you will hence homeowners want it, so you can greatest book customers.

Hazard insurance tends to be a critical component regarding the homeownership excursion having home buyers and you will realtors. To understand their advantages, let’s consider multiple crucial points.

Chances insurance coverage come with different label lengths, and you will homebuyers Connecticut personal loans should be aware of their alternatives. Particular guidelines give publicity for reduced terminology, although some offer security for more long periods. The option of label length will be line up on the homeowner’s demands and you can choice.

Issues insurance policy is perhaps not a-one-size-fits-every provider. Particular geographical places be subject to certain risks. As an example, section prone to flood or earthquakes might need chances insurance policies so you’re able to mitigate the fresh associated dangers. Due to the fact a realtor, understanding the book risks of the areas you serve are going to be indispensable in guiding your clients.

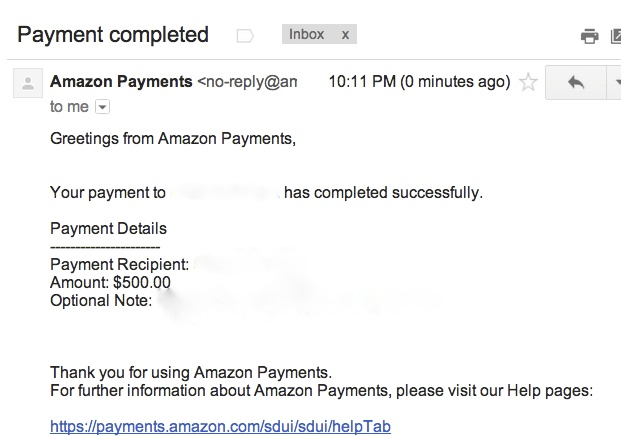

Oftentimes, risk insurance tends to be had a need to safe a mortgage. Lenders tend to wanted you to definitely borrowers features chances insurance policies prior to granting good mortgage.

Hazard Insurance versus. Home insurance

Possibility insurance is created specifically giving economic defense so you’re able to property owners in case there are unforeseen catastrophes. The new range of visibility available with danger insurance coverage can differ off one coverage to a different. However, it normally is sold with defense up against potential risks particularly fire, wind, hail, super, or any other disasters.

Although not, it is crucial to know what risk insurance will not safeguards. In place of homeowners insurance, that’s an even more wide-established particular visibility, possibilities insurance coverage will not extend the shelter to help you private house, responsibility states, theft, otherwise vandalism. A comprehensive home insurance coverage generally address such issue.

The possibility anywhere between threat insurance policies and you can homeowners insurance utilizes individual demands and you will points. If residents require safety beyond property ruin and find visibility to have individual homes and you will responsibility, homeowners insurance ‘s the a lot more full alternative.

Most readily useful 5 Reasons for Possibilities Insurance coverage

Attributes in a number of areas possess an unusually large risk risk on account of some things, along with flood areas, disturbance zones, and you may higher-offense parts. Here are a few trick good reason why a home otherwise visitors will get be a great fit to have danger insurance coverage:

- Geographic Vulnerability: Properties during the components more likely to disasters, such hurricanes, earthquakes, otherwise floods, may require threat insurance coverage so you can decrease economic risks.

- Comfort: Property owners which seek reassurance up against unanticipated incidents will benefit from risk insurance coverage.

- Property value Conservation: Hazard insurance rates may help cover and you can manage the value of a assets from the layer fix or replacement for can cost you if there is damage.

- Designed Coverage: It may be you can to help you modify hazard insurance coverage to generally meet the particular needs out-of home owners, making certain they have sufficient safety.

Not every citizen means issues insurance coverage, as the requirement relies on various points. Real estate professionals gamble a vital role in assisting readers influence if possibility insurance policy is the best choice.

Furthermore, real estate professionals is to teach their clients about the advantages of hazard insurance policies, discussing which may provide economic coverage in a situation off you would like and you may safeguard their property capital. By the effortlessly promoting this short article, agents is also enable their customers and make informed decisions regarding their insurance policies.

Is actually Threat Insurance policies Required by Mortgage lenders?

Sometimes, mortgage lenders wanted home owners to possess insurance policies since a disorder to have protecting a mortgage. So it needs commonly is sold with both danger coverage and you may accountability safeguards and is generally utilized in a property owners insurance plan.

Loan providers enforce this demands to guard its monetary passions on skills off property damage. Possibilities insurance policies means that the property stays properly protected, reducing the danger of a substantial monetary loss for the homeowner and the lender. It is important the real deal estate gurus to speak that it requirement so you can their clients, since it is a low-flexible facet of the homebuying process.

Does The client You prefer Hazard Insurance rates?

Threat insurance policies takes on a crucial character in the safeguarding homeowners facing sheer catastrophes and you can unforeseen danger. Even though it will bring rewarding publicity having property wreck resulting from specific potential risks, it’s important to know their limitations and comprehend the differences between possibilities insurance policies and home insurance.

Real estate agents and you may Real estate professionals, people in the Federal Association out-of Realtors, will be guide their clients toward need of chances insurance rates built on their particular factors, targeting the advantages within the highest-exposure elements and as a lender demands. In so doing, agents can get encourage their clients and come up with well-told behavior about their insurance, making certain their houses are protected from life’s unforeseen demands.